In fast-moving commerce, the Shopify vs Squarespace choice shapes operations, margins, and momentum. Searchers usually want clean guidance that separates short-term convenience from long-term headroom.

Shopify prioritizes selling at scale, while Squarespace optimizes design quality and editorial control. The best decision anchors to your growth plan, product complexity, and appetite for integrations.

Serious sellers lean toward Shopify for multi-channel tools, inventory depth, and a broad ecosystem that compounds over time. Visual brands that treat selling as supportive rather than central often feel at home on Squarespace.

Shopify Vs Squarespace at a Glance

Short orientation helps align expectations before deeper evaluation.

| Dimension | Shopify | Squarespace | Practical Angle |

| Best For | Growth-focused online stores | Visual brands and portfolios | Match to revenue model |

| Core Strength | Robust commerce stack | Beautiful presentation | Choose conversion or curation |

| Product Variants | Up to 100 variants, strong catalog tools | Limited variant depth | Apparel and configurable goods need variant scale |

| Ecosystem | Large Shopify App Store | Limited integrations | Adds capability but adds cost |

| POS & Channels | Full Shopify POS and social marketplaces | Basic in-person options | Omnichannel favors Shopify |

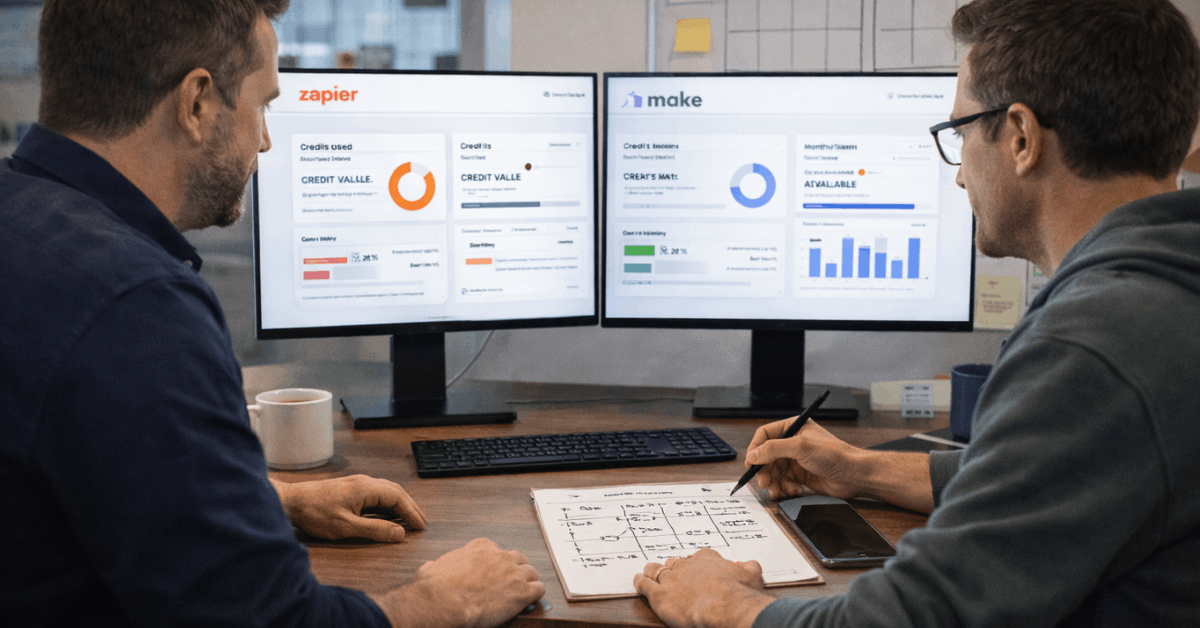

Pricing and Total Cost Of Ownership

Scaling decisions hinge on total cost, not headline plan prices. Plan tiers, payment processing, and add-ons combine into your true run-rate.

Base plans

Both platforms publish multiple tiers that unlock higher limits and features as revenue grows. Annual billing lowers effective monthly rates, while enterprise options raise ceilings for high-volume teams.

Hidden costs

Transaction-related fees, premium themes, and paid apps influence margins quickly. Shopify pricing can look higher on paper, yet effective rates tighten when using the native gateway and consolidated workflows.

Squarespace pricing feels approachable early, though limited extensions can push teams toward external tools or manual processes that cost time.

Three-year view

Stores that remain small typically spend less on Squarespace because needs stay simple.

Stores that grow into thousands of orders often find Shopify more cost-effective, since operational features reduce labor and leakage while revenue-facing apps recapture abandoned carts and increase average order values.

Budget line items shift, yet the net result favors capability when volume rises.

Ease Of Use and Learning Curve

New builders appreciate how quickly Squarespace publishes attractive pages. The drag-and-drop editor feels like designing a magazine spread, and essential commerce settings remain approachable.

That comfort matters during validation phases, pop-up campaigns, and lightweight catalogs.

Operational teams recognize Shopify’s admin as a business dashboard. Products, orders, customers, and inventory sit at the center, which introduces more decisions early. That extra setup pays off when shipping rules expand, locations multiply, and workflows need automation rather than workarounds.

Design and Theming

Squarespace templates prioritize visual storytelling and consistent typography that flatters portfolios and lifestyle catalogs. Minimal configuration delivers polished results that elevate perceived brand quality.

Merchandising photography, editorial pages, and blog-led traffic benefit immediately from built-in layouts. Shopify themes emphasize shoppability and conversion.

Navigation, product data density, mobile performance, and checkout clarity take precedence. Premium themes still look refined, yet patterns serve transactions first. Teams focused on cart conversion typically prefer this bias, especially on mobile.

AI Features In 2026

Shopify Magic covers commerce-centric tasks such as description drafts, email subject suggestions, merchandising insights, and light automation prompts. Sidekick can surface patterns in store data and propose operational changes that save time.

Creative teams exploring generative helpers still benefit, yet the emphasis remains revenue impact. Squarespace’s Blueprint AI centers on structure and presentation.

Draft sites spin up quickly using content cues, then adapt layouts for coherence and brand tone. Lightweight copy tools support pages and blog posts, keeping the focus on aesthetics and clarity.

Ecommerce Features and Scalability

Serious growth reveals gaps quickly, so treat this section as the decision core.

Product Management

Shopify handles unlimited products, up to 100 variants per SKU, and catalog enrichment through metafields. Bulk editing, collections logic, and multi-location inventory reduce manual rework.

Subscriptions, bundles, and digital goods slot in through native features or apps when nuance is required. Squarespace supports essential products and options, yet variant depth and bulk operations remain limited, which frustrates configurable categories like apparel.

Shipping and Fulfillment

Shopify’s shipping rules, label printing, and carrier integrations streamline picking and packing while reducing errors.

Connections to third-party logistics, marketplaces, and retail locations keep stock synchronized. Squarespace supports flat and weight-based rates for simple cases, then relies on external workarounds for advanced scenarios.

Tax and Compliance

Automated sales tax, VAT, and GST handling inside Shopify reduces audit risk as footprints widen. Squarespace covers basics, but multi-region complexity typically requires manual effort.

Scalability Reality

Side hustles, pop-ups, and boutique catalogs run well on either platform. Growth to multi-thousand SKUs, wholesale tiers, and multiple locations favors Shopify because operational friction stays manageable while analytics deepen.

Performance, Speed, and Security

Loading speed affects conversion and search visibility. Shopify’s commerce-first architecture and theme patterns aim for fast product discovery and reliable checkout paths, even when pages carry heavy inventory logic.

Squarespace delivers quick rendering for portfolio and editorial content, then slows modestly as product density rises. Both platforms ship SSL, modern payment methods, and compliance baselines.

Fraud analysis on Shopify benefits from aggregate signals across many merchants, which helps reduce chargebacks for higher-risk categories. Backup strategy still deserves attention either way, using exports and third-party tools where appropriate.

Apps, Integrations, and Ecosystem

Breadth matters once native features run out. The Shopify App Store covers advanced merchandising, automation, subscriptions, analytics, loyalty, returns, and almost every edge case that emerges during growth.

Powerful additions do add monthly cost, although recovered revenue and labor savings typically offset spend when configured well.

Squarespace integrations remain curated and intentionally limited. Core marketing and publishing use cases feel covered, while niche commerce requirements may need custom work or compromises. Simplicity wins early; extensibility wins later.

Marketing, SEO, and Analytics

Content-led brands often succeed on Squarespace because blogging, pages, and visual composition align naturally with search intent. Clean URLs, meta fields, and sitemaps support fundamentals that your editorial calendar can exploit.

Product-led SEO tends to favor Shopify due to structured data, scalable collections, and performance characteristics that help crawl budgets.

Native reports surface revenue-relevant metrics like cohort behavior and channel conversion, then deepen further on higher tiers or through analytics apps. Squarespace analytics cover website basics and commerce summaries, which serve smaller catalogs well.

Dropshipping and Point Of Sale

Teams building catalog-light models appreciate how quickly a Shopify store connects to major print-on-demand and marketplace-sourcing tools. Automated order routing and inventory sync reduce operational drag that normally breaks thin margins.

Squarespace does not target dropshipping as a native model, so maintaining integrations becomes harder. Selling in person calls for hardware, staff roles, and unified customer profiles.

Shopify POS ties online and retail inventory together, supports BOPIS, and keeps purchase history unified across channels. Squarespace supports basic in-person payments through partners, yet omnichannel operations feel limited.

International Selling and Global Commerce

Regional expectations for price display, payment methods, and delivery transparency vary widely. Shopify Markets centralizes currencies, duties calculation, localized domains, and checkout language.

Those controls lift trust at the exact moment customers decide to pay. Squarespace offers multi-currency basics and translations, but comprehensive localization typically requires extra manual effort.

Migration Guidance

Platform switches introduce risk, although careful planning protects revenue and rankings.

- Why businesses migrate: Creative brands often launch on Squarespace, then shift when catalogs, variants, or wholesale channels exceed comfort. Growth-stage stores move to Shopify for multi-location inventory, automation, and deeper analytics.

- What moves: Expect to transfer products, customers, orders, pages, and blog content. Media assets need mapping. Preserve SKU integrity to prevent downstream fulfillment and reporting issues.

- SEO protection: Maintain URL structure when possible, implement complete 301 redirects, and keep titles and descriptions stable through the cutover. Monitor indexing and rankings for several weeks while addressing coverage issues quickly.

- Budget and timeline: Small catalogs often complete in one to two weeks. Medium catalogs need several more for QA. Established stores should reserve budget for expert help, since avoiding downtime and preserving search equity pays for itself.

Conclusion

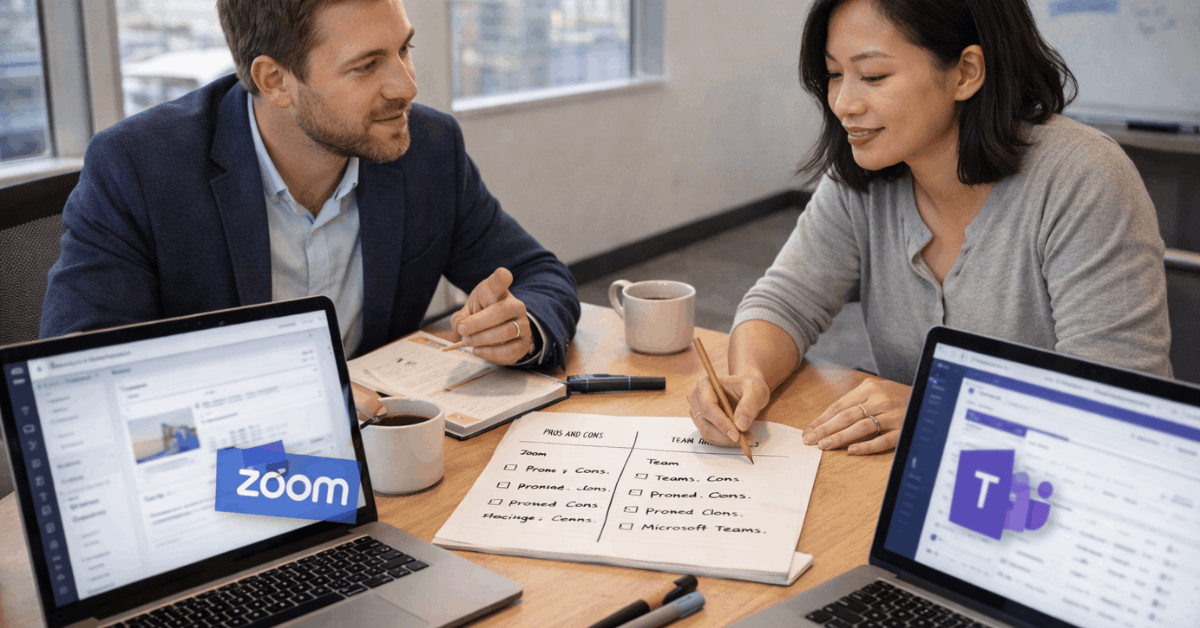

Final choice hinges on your growth path, catalog complexity, and integration appetite. Pick Shopify when multi-channel scale, variant depth, and automation directly drive margins.

Pick Squarespace when design control, editorial polish, and simple catalogs lead the brand story. Map non-negotiables, model three-year total cost, run a 48-hour build test on both, then commit.