In competitive markets, CRM decisions compound. Teams that pick a platform aligned to growth plans avoid costly re-platforms and stalled pipelines.

HubSpot vs Salesforce is the most common fork in the road because both cover sales, marketing, service, analytics, and extensibility at global scale.

Adoption data still shows near ubiquity for CRMs across modern organizations, which raises the stakes on choosing a system that will not cap future scale.

Quick Comparison at a Glance

Short context helps frame the detailed sections that follow. Both platforms offer broad suites, strong ecosystems, and serious AI roadmaps. Differences show up in pricing tiers, depth of enterprise customization, and how far the app marketplace extends into line-of-business use cases.

| Area | HubSpot | Salesforce |

| Starting Plan | Starter seats typically start at about $20 per month, with periodic first-year discounts | Starter Suite priced at $25 per user per month |

| Free Option | HubSpot free CRM tier available | Free Suite for up to 2 users now available |

| Ease Of Use | Generally faster to learn for nontechnical teams | Rich features require training and admin time |

| Customization | Strong configuration with lighter programmatic depth | Deep enterprise customization and metadata-driven platform |

| Best For | Marketing-led growth and SMB to mid-market teams | Complex sales operations and enterprise scale |

HubSpot pricing and discounts vary by bundle and seat limits; Salesforce pricing reflects current public edition pricing.

Core Platforms and Modules

A clear map of each vendor’s core modules prevents feature confusion. Suites overlap in name, yet bundling and scope differ. Expect parallel coverage of sales, service, marketing, content, data, and commerce. Differences emerge in app ecosystems, governance, and how admin work scales across departments.

HubSpot

HubSpot groups products into Marketing Hub, Sales Hub, Service Hub, Content Hub, Data Hub, and Commerce Hub, all tied to a shared Smart CRM.

Content Hub is the successor to CMS Hub after an April 2024 rebrand that put more AI and content workflow features under one umbrella. The HubSpot free CRM tier remains a compelling entry path for small teams validating processes.

Salesforce

Salesforce centers on Sales Cloud, Service Cloud, Marketing Cloud, Commerce Cloud, Data Cloud, and the Salesforce AppExchange integrations marketplace. AppExchange now lists more than nine thousand prebuilt and customizable applications that extend Salesforce into hundreds of niches. Tableau analytics and Slack deepen the stack for reporting, collaboration, and event-driven workflows.

Performance Benchmarks That Matter

Scope out practical performance factors rather than feature catalogs alone. Reporting depth, automation headroom, ecosystem breadth, and everyday usability govern scale. Each category below weighs maturity, breadth, and operational fit.

Reporting and Analytics

Salesforce leads on enterprise reporting when multi-object data, forecasting, and governed analytics drive decisions.

Tableau elevates visualization and model-driven analysis across large datasets that span sales, service, and marketing. Teams that centralize pipelines across regions and business units typically see faster analyst throughput inside Salesforce’s data model.

Marketing Tools and Features

HubSpot wins for consolidated marketing execution. Native tools for email, automation, landing pages, and content sit close to contact timelines, which shortens setup for campaign-led teams.

Content Hub folds website and content operations into the same console that sales and service already use.

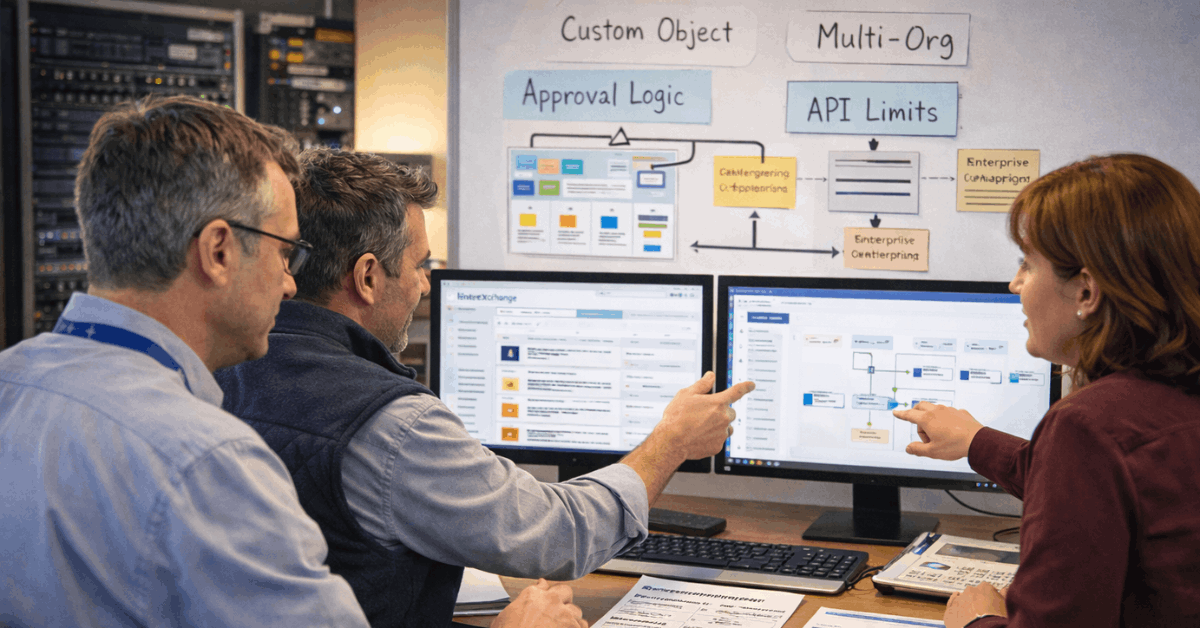

Growth and Scalability

Salesforce scalability for enterprises remains unmatched when growth requires granular permissions, complex approval flows, custom objects, and multi-org strategies.

The platform’s metadata foundation plus AppExchange depth supports industry templates and regulated workflows. HubSpot scales strongly through mid-market needs, although highly specialized enterprise processes may require more customization than its design targets.

Integrations and Ecosystem

Salesforce wins the ecosystem race. Salesforce AppExchange integrations cover payments, CPQ, quote-to-cash, field service, vertical ERPs, and compliance tooling at breadth and depth.

The marketplace now cites 9,000+ apps, along with implementation partners that specialize by industry and region. HubSpot maintains a healthy catalog and solutions partners, yet enterprises frequently find required depth on AppExchange first.

Ease Of Use and Implementation

HubSpot earns points for approachability and faster early wins. Templates, opinionated defaults, and guided setup reduce friction for small teams building first pipelines and campaigns.

Salesforce rewards investment in admins and solution architects, which pays back when complex workflows, data sharing models, and center-of-excellence patterns become mandatory.

A realistic CRM implementation timeline should reflect internal skills, data complexity, and required integrations rather than marketing pages alone.

Target Markets and Fit

Audience fit narrows the choice quickly. Pricing tiers, governance needs, and process complexity drive the recommendation more than any one feature. Use this lens to avoid deploying a system that either caps growth or overextends the admin footprint.

HubSpot

SMBs and mid-market teams running inbound programs see fast time to value in HubSpot. Consolidated execution reduces swivel between tools, and reporting lines up well for content-led acquisition models.

Agencies and startups often adopt HubSpot first, then add complexity in measured steps using Sales Hub and Service Hub once revenue and support volumes increase.

Salesforce

Enterprises that orchestrate multi-segment, multi-region sales motions benefit from Salesforce’s governance and extensibility.

Complex CPQ, partner programs, field teams, and industry-specific compliance push the platform’s strengths to the front. Migration stories into Salesforce are common once scale drives needs beyond lightweight automations and basic object models.

Pricing Models In Practice

Budget planning should account for seats, editions, add-ons, implementation, and partner services. Salesforce Sales pricing currently spans Starter at $25 per user per month, Pro at $100, Enterprise at $175, and Unlimited at $350, with Agentforce 1 Sales at the top tier.

A new Free Suite supports up to two users for simple CRM needs. HubSpot runs a discounted Starter bundle for first-year seats during promotions and typically lists Starter at about $20 per seat when not discounted.

Promotional Starter pricing as of January 5, 2026 reflects limited-time first-year discounts.

Marketing Automation and Advanced Analytics

Marketing automation and advanced analytics often push buyers into higher tiers on both platforms.

Marketing Cloud editions price differently from Sales by organization, while HubSpot Professional and Enterprise tiers introduce required onboarding and higher automation ceilings.

Those structural realities mean Salesforce vs HubSpot pricing comparisons should model features and required limits rather than sticker prices alone.

AI Roadmaps and What To Expect

AI strategy now influences both daily usability and long-term platform bets. Pay attention to productized agents, governance, and how AI features attach to editions.

HubSpot

HubSpot ships AI under the Breeze umbrella, including assistants and AI-supported workflows across content, marketing, and sales. ChatSpot and content assistance remain core entry points, while newer Breeze capabilities appear inside modern bundles.

These investments keep HubSpot Marketing Hub features close to campaign execution for teams that value consolidated authoring and analytics.

Salesforce

Salesforce announced Agentforce as a suite of autonomous AI agents and continues to evolve Einstein across clouds. Public materials emphasize agentic workflows across service, sales, marketing, and commerce, alongside partnerships that feed model choice and governance.

Recent pricing pages and event recaps reflect the Agentforce shift and expanded tiers that package AI access more explicitly. AI in CRM platforms will keep accelerating in both ecosystems through 2026.

Decision Framework: Which Service Scales Better

Short criteria help narrow a final pick without spreadsheet fatigue.

- Pick HubSpot when consolidated execution matters more than deep customization, and the team prioritizes speed to value across marketing and sales. A HubSpot onboarding experience usually completes faster for nontechnical users who need practical guardrails.

- Pick Salesforce when process complexity, governed analytics, and multi-team orchestration drive requirements. Long-run total cost aligns when automation, security, and partner ecosystems offset re-platform risk.

- Use HubSpot for greenfield go-to-market motion validation, then reassess at each growth inflection for gaps in advanced workflows, CPQ, or data governance.

- Use Salesforce for multi-region, multi-segment revenue engines that require granular permissions, custom objects, and advanced forecasting tied to Data Cloud and Tableau.

- Phase AI adoption rather than turning every feature on day one. Start with sales email syncing and case summarization, then pilot agents where clear guardrails and measurable outcomes exist.

Final Verdict

In scale-sensitive roadmaps, Salesforce edges HubSpot for long-term extensibility, governance, and breadth of enterprise modules. AppExchange depth and evolving Agentforce tiers position Salesforce as the safer bet for complex, regulated, or rapidly diversifying operations.

HubSpot remains a strong choice for marketing-led teams and SMB to mid-market organizations that value an integrated, approachable platform and predictable early wins.

The better answer comes down to process complexity, admin appetite, and the integrations required to keep data and decisions flowing.