In fast-moving teams, automation only works when people across roles can run it confidently. Searches for Zapier vs Make usually start with cost and connectors, yet long-term success depends on ease of building, reliability at scale, and governance that does not collapse under growth.

The quick path forward looks like this: pick the platform that non-technical staff can use safely, model costs on real workload, and confirm the integration ecosystem covers today’s and tomorrow’s tools.

Make Vs Zapier at a Glance

Enterprises care about quick wins that do not create technical debt. A side-by-side snapshot helps frame the deeper sections below and sets expectations around deployment speed, integration breadth, pricing signals, and AI-era features.

| Dimension | Zapier | Make |

| Time To Value | Minutes to deploy for most teams | More setup for complex scenarios |

| Integration Ecosystem | 8,000+ apps as of January 2026 | Around 2,800 apps as of January 2026 |

| Pricing Model | Task-based, unlimited filters and logic | Credit-based, credits spent on many internal steps |

| AI Assistance | Built-in Copilot and AI actions | Manual configuration for agents and prompts |

| Extra Tools | Tables, Interfaces, Chatbots, Canvas, Functions | Data store and Agents for advanced use |

Ease Of Use and Team Adoption

Non-technical adoption determines whether pilots become organization-wide programs. A platform that lets marketing, sales, HR, and operations maintain their own automations reduces ticket volume, avoids dependency on specialists, and keeps momentum during process changes.

Non-Technical Builders

Zapier focuses on plain-language setup that feels familiar to operators who live in CRM screens and spreadsheets.

Templates, readable step names, and AI assistance lower the barrier for creating and updating flows after small workflow tweaks. Because steps such as filters, formatters, and error handling are presented in everyday terms, adjustments happen quickly during live iterations.

Advanced Users

Make presents a powerful, visual canvas that excels when scenarios branch heavily, transform payloads, or call APIs directly. Routers, iterators, aggregators, and the HTTP module reward technical proficiency, and the big-picture map helps reason about multi-path logic.

Because the learning curve runs steeper for non-technical staff, organizations often centralize Make scenario ownership inside a specialist team.

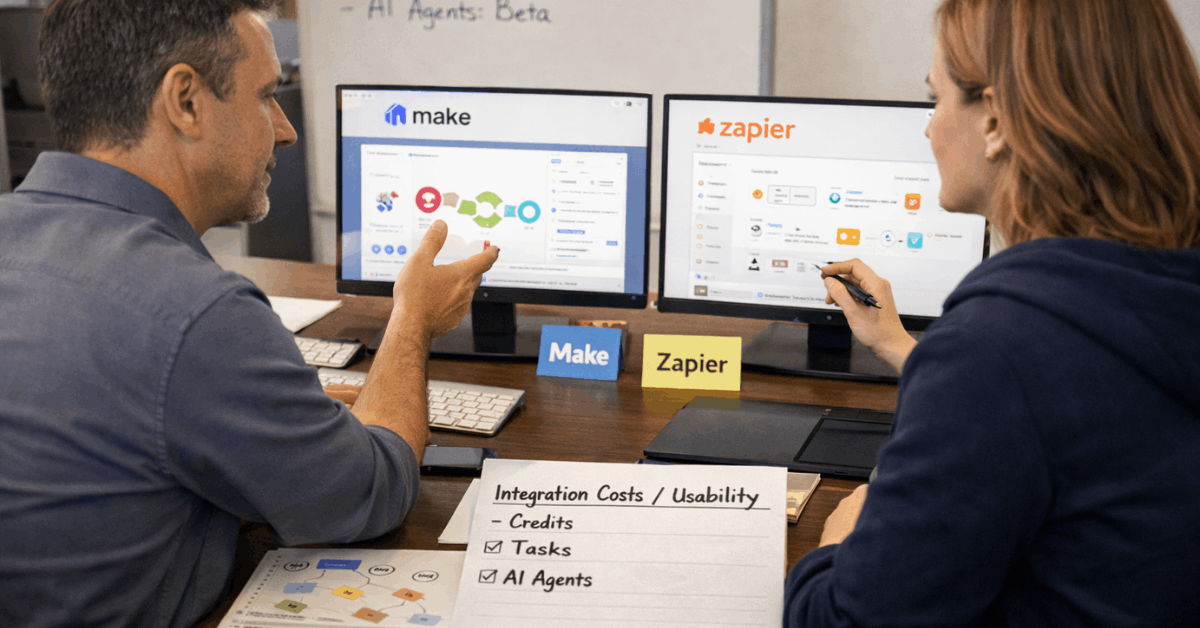

Pricing and Total Cost Of Ownership

Finance leaders need pricing that behaves predictably as volumes grow. Operations leaders care about the time required to manage that pricing in practice. A short orientation clarifies where each model fits and where hidden overhead can appear.

- Task-based billing in Zapier charges for completed work actions rather than internal logic, polling, or failed runs, which simplifies forecasting for recurring workflows.

- Credit-based billing in Make consumes credits for many internal steps, including checks and certain AI operations, which can require ongoing optimization to control month-to-month swings.

- Testing, filtering, formatting, routing, and error handling do not reduce Zapier task quotas, which keeps experimentation safe during buildouts.

- Polling schedules, retries, and multi-branch complexity can increase Make credit usage even when little new data arrives, which encourages external triggers or redesigns to conserve credits.

Because budgets depend on usage patterns, teams should model two or three representative automations across low, medium, and peak volumes.

That exercise surfaces cost curves and highlights where either platform might require policy guardrails or scenario redesign to keep spend in line.

Integration Ecosystem Breadth

Breadth matters when a company runs dozens of systems across departments, pilots new tools quarterly, and integrates niche vertical platforms. As of January 2026, Zapier lists over 8,000 pre-built apps that span HR, finance, sales, marketing, IT, data, and AI categories, while Make lists roughly 2,800.

Those numbers move over time, yet the gap signals practical differences during vendor changes, acquisitions, or regional expansions. When teams adopt emerging products or industry-specific systems, the odds of finding an existing Zapier connector trend higher, which shortens rollout and avoids custom API work.

Deep, app-specific actions remain a Make strength for concentrated stacks where one or two core systems dominate daily workflows.

AI Orchestration and Built-In Tools

Automation is shifting toward orchestration, where data lives in shared stores, front ends collect structured inputs, and AI routes work intelligently rather than following narrow scripts.

Zapier bundles Tables for structured records, Interfaces for branded forms and light internal tools, Chatbots for AI interactions, Canvas for visual process mapping, and Functions for web-based, custom logic.

Make provides data storage and Agents for AI behavior, which cover advanced use cases for technical teams that prefer to wire components explicitly. Platform fit depends on how much of the stack should live in the automation layer versus external databases, forms, and UI builders already in place.

Scalability and Reliability

Enterprise rollouts stress platforms in ways pilots rarely do. Zapier emphasizes horizontal scaling, automatic handling for upstream API changes, outage detection, and intelligent throttling during spikes so runs complete rather than fail noisily.

Those guardrails reduce babysitting during launches and seasonal peaks. Make offers fine-grained control that power users appreciate, including advanced routers and iterators, plus visibility across branches that aids root-cause analysis.

Because deeply nested scenarios can grow complex, organizations typically document standards for error handling, naming, and retries, then assign owners who monitor and tune high-volume paths.

Security and Governance

Security teams expect SOC 2 Type II controls, GDPR alignment, encryption in transit and at rest, and enterprise features such as SSO, audit logs, and role-based permissions.

Zapier Enterprise centralizes governance through workspaces, granular privileges, detailed logs, and default opt-outs for model training to simplify compliance reviews. Make Enterprise supports SSO, SOC 2, GDPR, and admin roles, though process discipline frequently determines how consistently teams implement guardrails.

Whichever platform you choose, formalize environment separation for production and testing, require approvals for sensitive scopes, and audit changes on a regular cadence.

Feature Depth For Builders

Complexity shows up in the small details builders touch daily. Looping, paths, sub-Zaps, custom actions, and AI-assisted API setup expand Zapier’s ceiling for intricate work while keeping step labels and data mapping transparent for non-technical stakeholders.

Iterators, aggregators, and the HTTP module in Make remain excellent tools for shaping payloads, merging arrays, and speaking directly to APIs when connectors do not expose a needed action.

Because both products evolve quickly, set aside time each quarter to review newly released features that might simplify or harden existing flows.

Use Cases and Best Fit

Choosing a platform gets easier when mapped to clear scenarios. A short decision guide frames typical enterprise patterns and highlights where each tool shines without overcomplicating the call.

Pick Zapier when multiple non-technical teams will build and maintain flows, when predictable task-based costs reduce governance overhead, when the integration ecosystem must cover thousands of SaaS choices, and when AI-era tooling like Tables, Interfaces, and Chatbots removes the need for extra vendors.

Pick Make when a central automation group owns builds, when visual scenario mapping and multi-branch logic sit at the core of requirements, when HTTP calls and advanced aggregations appear in every project, and when credit-based optimization fits the team’s operational habits.

Migration and Coexistence Tips

Hybrid environments are common during contract cycles and team restructures. Start by inventorying current automations, grouping them into quick wins, complex dependencies, and risky processes.

Low-risk, high-value candidates often include notifications, lead enrichment, ticket triage, and spreadsheet updates, which move cleanly between platforms.

High-complexity scenarios that touch revenue operations or finance deserve phased migrations with parallel runs and scoped fallbacks. Clear naming standards, shared credential vaults, and modular building patterns lower friction if flows are ever moved again.

ROI and Measurement

Leadership buy-in improves when impact reporting is consistent and tied to departmental goals. Track hours saved, error rate reductions, time to deploy new processes, and the volume of runs per team.

In task-based environments, report consumption relative to outcomes rather than raw counts, since unlimited filters and logic steps do not reflect actual work performed.

In credit-based environments, publish optimization wins that reduced consumption without hurting reliability, including triggers moved to webhooks and consolidations of redundant branches.

Verdict: Picking The Right Platform

Enterprises that aim to empower business units while keeping governance tight often lean toward Zapier for ease of use, breadth of connectors, and bundled tooling that minimizes extra vendors.

Organizations that centralize automation under a technical team and prize visual, branch-heavy logic frequently select Make to maximize control and expressiveness.

Either route can succeed. The best outcome arrives when platform selection matches builder profile, governance model, and integration roadmap rather than headline pricing alone.